|

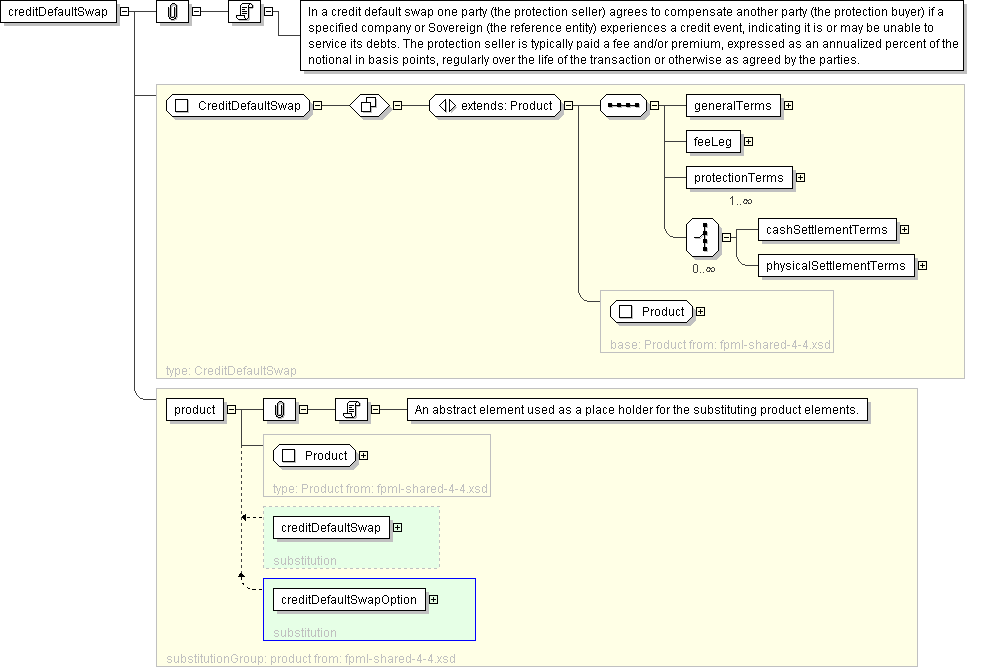

| Name | creditDefaultSwap |

|---|---|

| Used by (from the same schema document) | Complex Type CreditDefaultSwapOption |

| Type | CreditDefaultSwap |

| Nillable | no |

| Abstract | no |

| Documentation | In a credit default swap one party (the protection seller) agrees to compensate another party (the protection buyer) if a specified company or Sovereign (the reference entity) experiences a credit event, indicating it is or may be unable to service its debts. The protection seller is typically paid a fee and/or premium, expressed as an annualized percent of the notional in basis points, regularly over the life of the transaction or otherwise as agreed by the parties. |

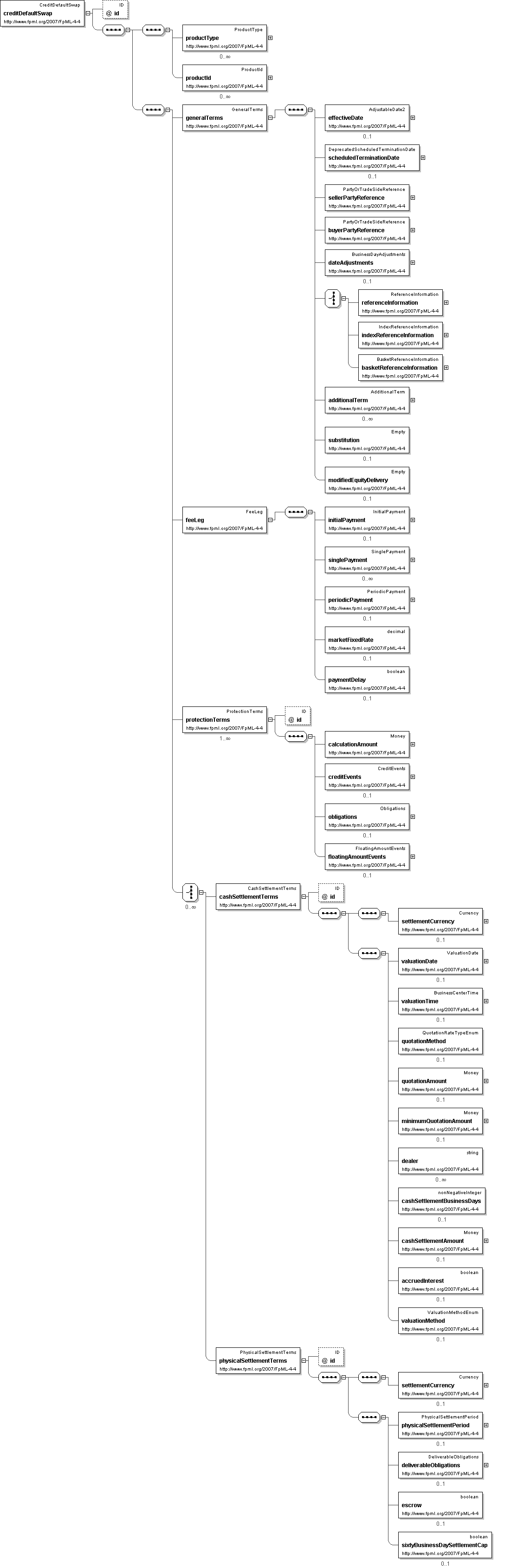

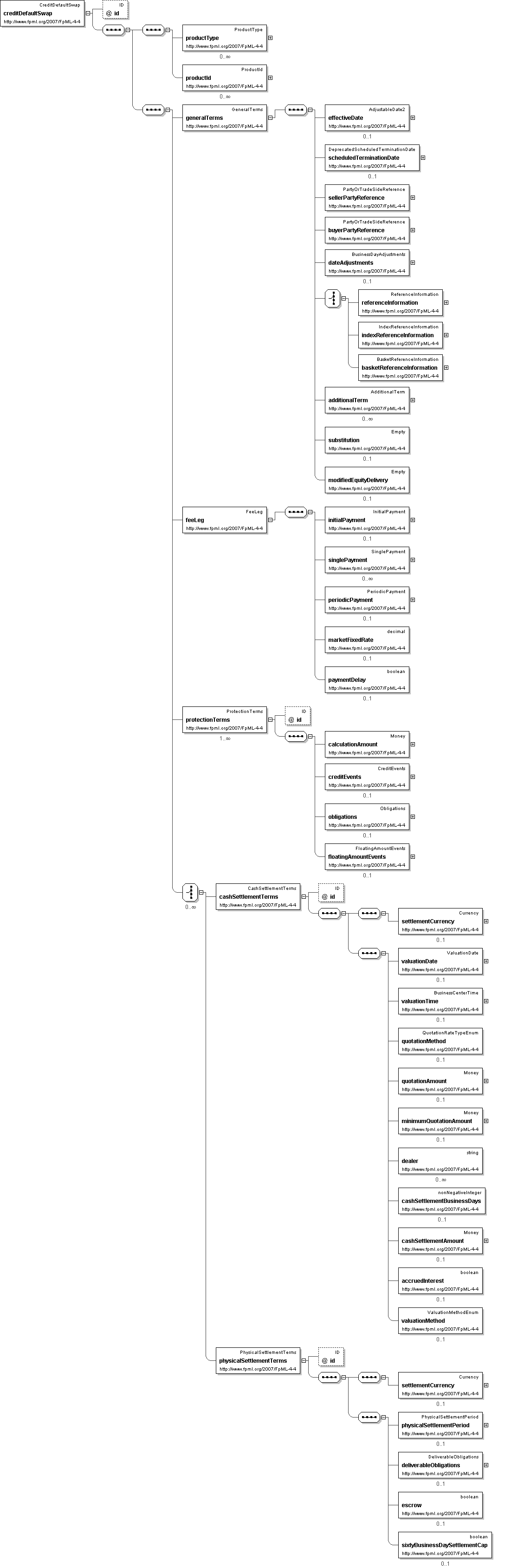

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'This element contains all the data that appears in the section entitled \"1. General Terms\" in the 2003 ISDA Credit Derivatives Confirmation.'

'This element contains all the terms relevant to defining the fixed amounts/payments per the applicable ISDA definitions.'

'This element contains all the terms relevant to defining the applicable floating rate payer calculation amount, credit events and associated conditions to settlement, and reference obligations.'

'This element contains all the ISDA terms relevant to cash settlement for when cash settlement is applicable. ISDA 2003 Term: Cash Settlement'

'This element contains all the ISDA terms relevant to physical settlement for when physical settlement is applicable. ISDA 2003 Term: Physical Settlement'