|

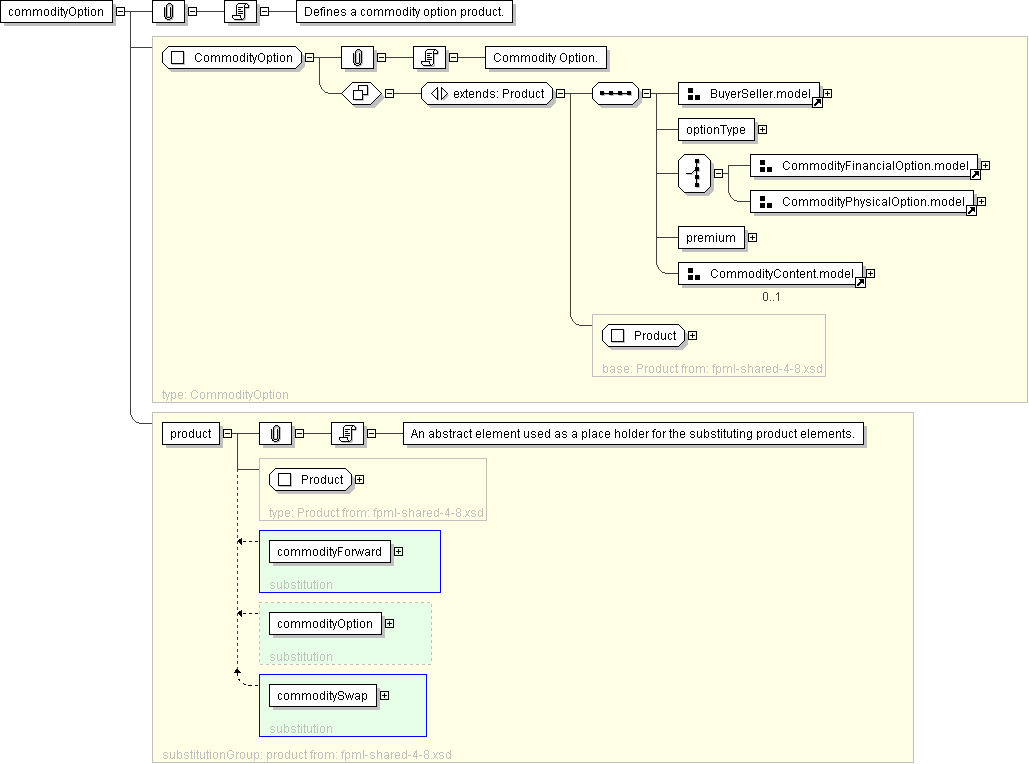

| Name | commodityOption |

|---|---|

| Type | CommodityOption |

| Nillable | no |

| Abstract | no |

| Documentation | Defines a commodity option product. |

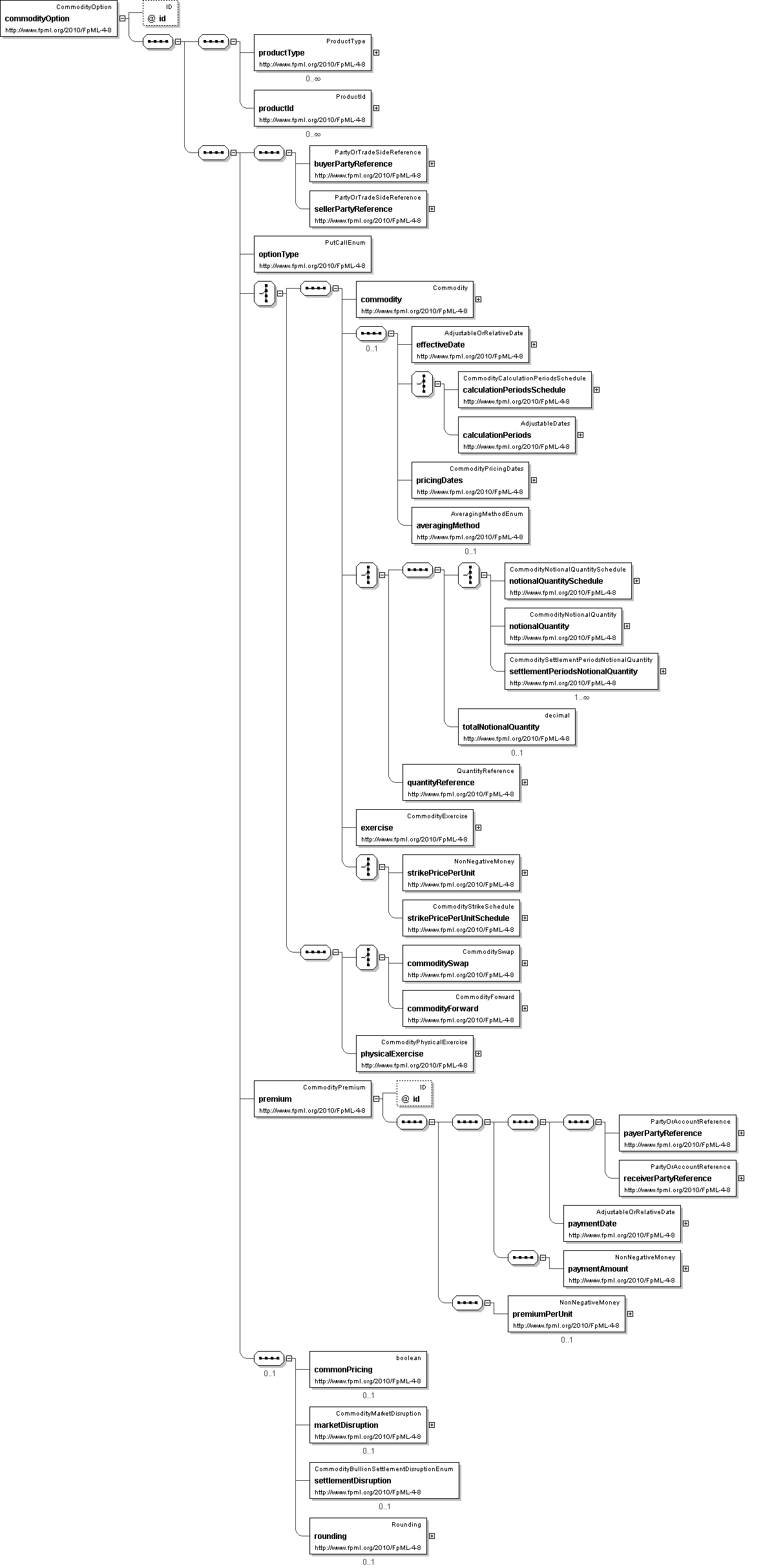

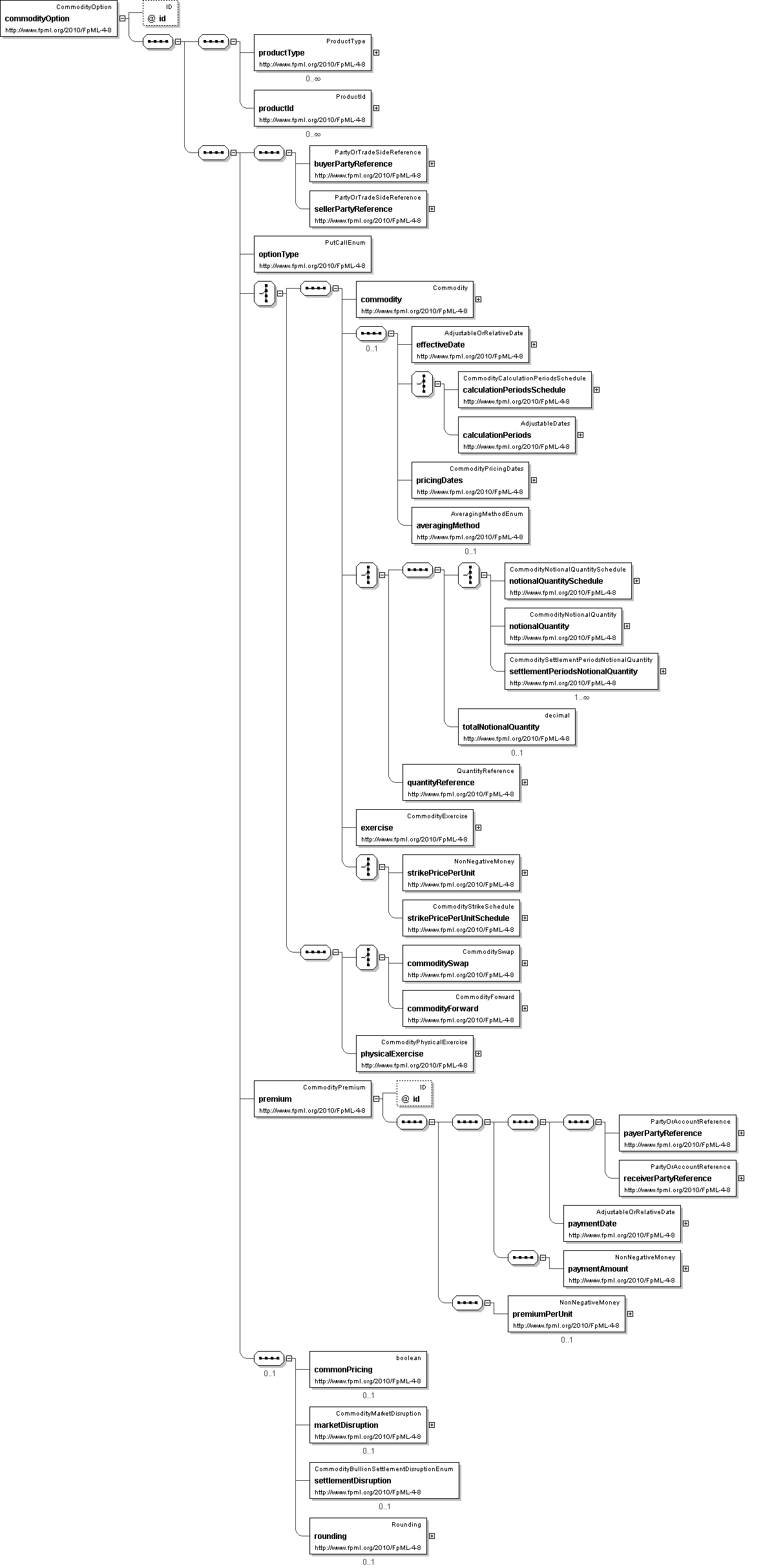

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'A reference to the party that buys this instrument, ie. pays for this instrument and receives the rights defined by it. See 2000 ISDA definitions Article 11.1 (b). In the case of FRAs this the fixed rate payer.'

'A reference to the party that sells (\"writes\") this instrument, i.e. that grants the rights defined by this instrument and in return receives a payment for it. See 2000 ISDA definitions Article 11.1 (a). In the case of FRAs this is the floating rate payer.'

'Specifies the underlying component. At the time of the initial schema design, only underlyers of type Commodity are supported; the choice group in the future could offer the possibility of adding other types later.'

'A group containing properties specific to Asian options.'

'The effective date of the Commodity Option Transaction. Note that the Termination/Expiration Date should be specified in expirationDate within the CommodityAmericanExercise type or the CommodityEuropeanExercise type, as applicable.'

'A parametric representation of the Calculation Periods of the Commodity Option Transaction.'

'An absolute representation of the Calculation Period start dates of the Commodity Option Transaction.'

'The dates on which the option will price.'

'The Method of Averaging if there is more than one Pricing Date.'

'Allows the documentation of a shaped notional trade where the notional changes over the life of the transaction.'

'For an electricity transaction, the Notional Quantity for a one or more groups of Settlement Periods to which the Notional Quantity is based. If the schedule differs for different groups of Settlement Periods, this element should be repeated.'

'A pointer style reference to a quantity defined on another leg.'

'The parameters for defining how the commodity option can be exercised and how it is settled.'

'The currency amount of the strike price per unit.'

'The parameters for defining how the commodity option can be exercised into a physical transaction.'

'Common pricing may be relevant for a Transaction that references more than one Commodity Reference Price. If Common Pricing is not specified as applicable, it will be deemed not to apply.'

'Market disruption events as defined in the ISDA 1993 Commodity Definitions or in ISDA 2005 Commodity Definitions, as applicable.'

'The consequences of Bullion Settlement Disruption Events.'