Namespace: |

|

Content: |

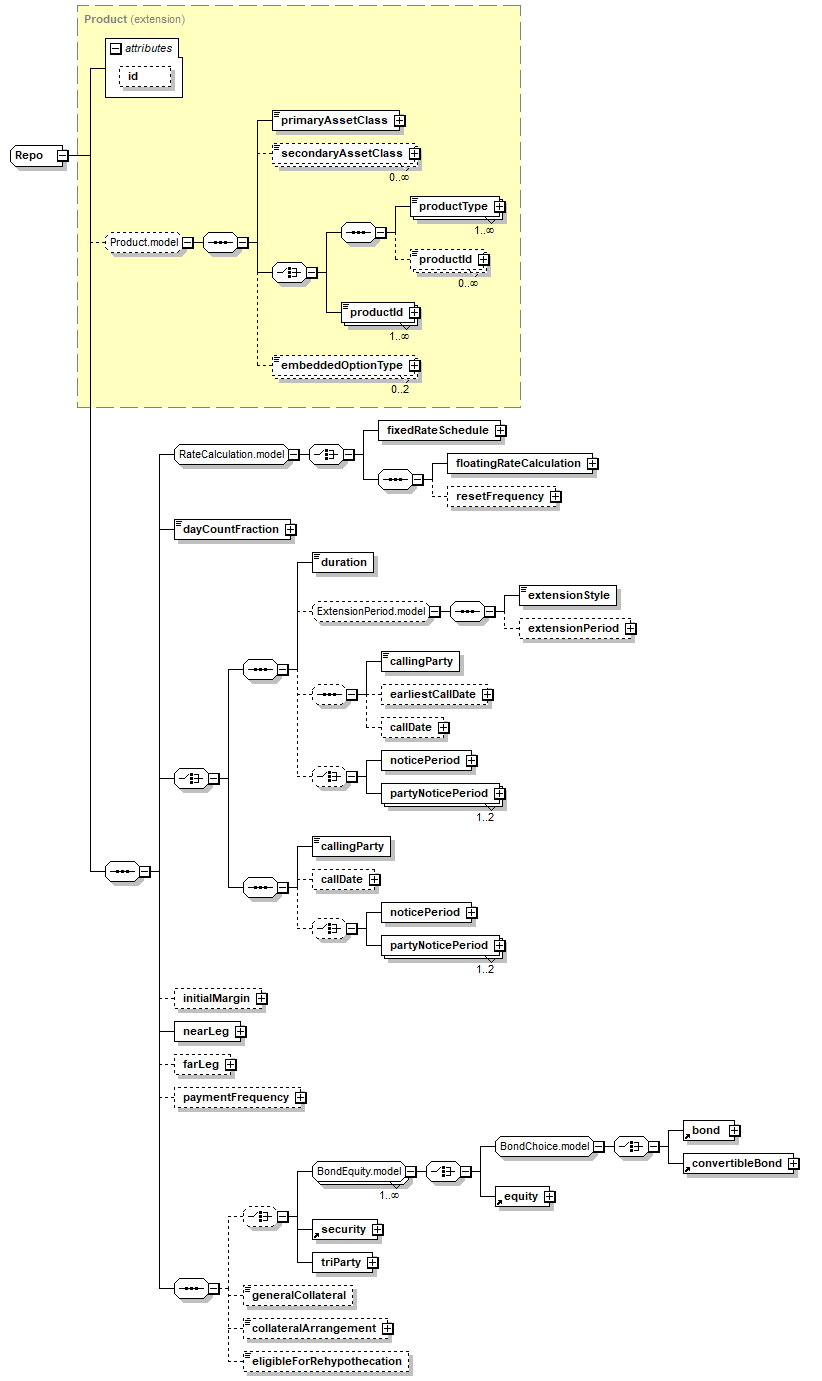

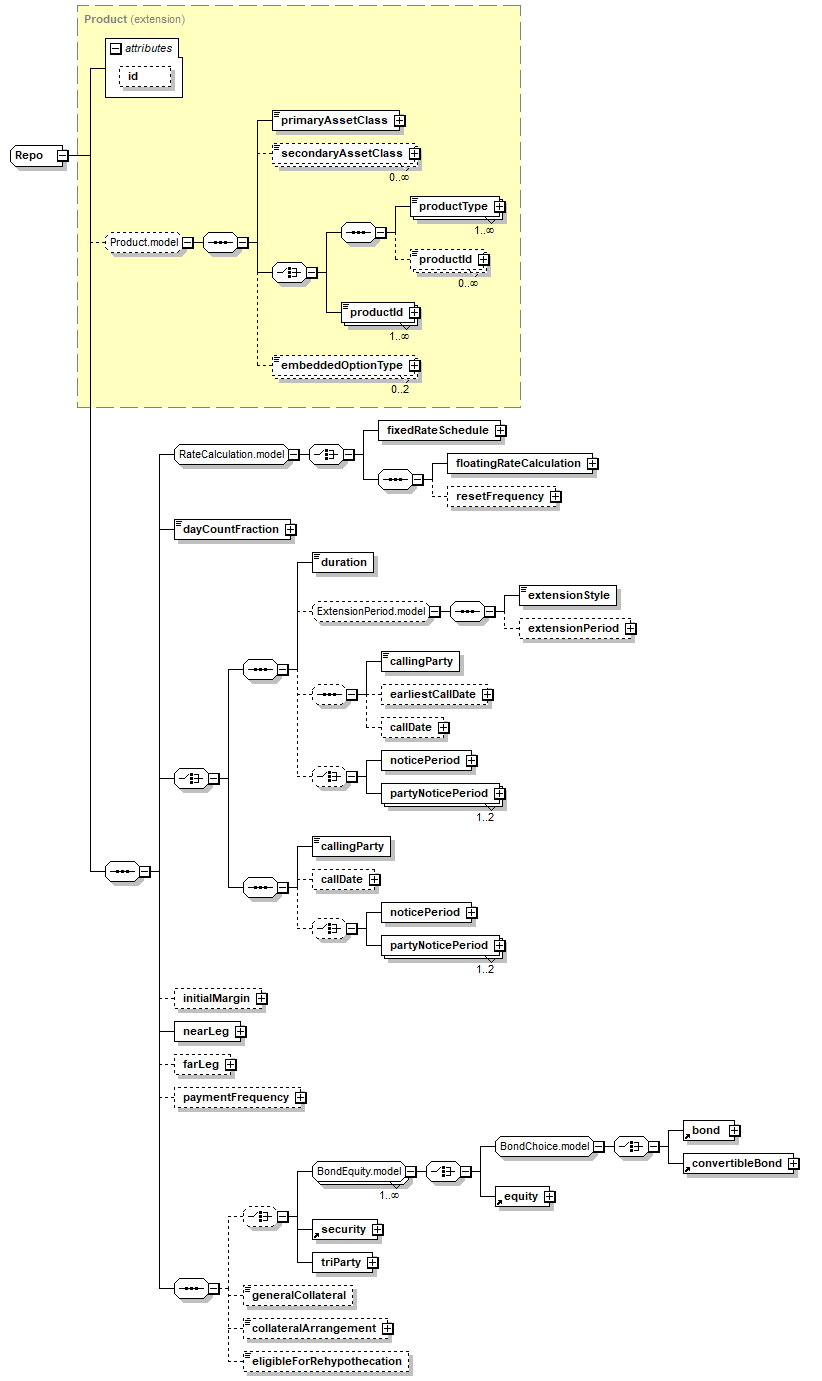

complex, 1 attribute, 34 elements |

Defined: |

globally in fpml-repo-5-11.xsd; see XML source |

Includes: |

definitions of 20 elements |

Used: |

at 1 location |

XML Representation Summary |

||||||

<... |

||||||

|

||||||

> |

||||||

|

||||||

</...> |

||||||

|

Type Derivation Tree

Product (extension)

|

|

<xsd:complexContent>

<xsd:extension base="Product">

</xsd:complexContent>

<xsd:sequence>

</xsd:extension>

<xsd:group ref="RateCalculation.model"/>

</xsd:sequence>

<xsd:choice>

<xsd:sequence>

</xsd:choice>

<xsd:element name="duration" type="RepoDurationEnum"/>

</xsd:sequence>

<xsd:sequence minOccurs="0">

</xsd:sequence>

<xsd:choice minOccurs="0">

</xsd:choice>

<xsd:sequence fpml-annotation:deprecated="true" fpml-annotation:deprecatedReason="Deprecated the Open-Repo call/notice group in favor of the relax model to allow extension and/or call/notice properties to be produced in association with duration [Open or Term or Overnight]">

<xsd:element name="callingParty" type="CallingPartyEnum"/>

</xsd:sequence>

<xsd:choice minOccurs="0">

</xsd:choice>

<xsd:sequence>

</xsd:sequence>

</xsd:complexType>

|

Type: |

AdjustableOrRelativeDate, complex content |

Type: |

AdjustableOrRelativeDate, complex content |

Type: |

CallingPartyEnum, simple content |

|

enumeration of xsd:token

|

Enumeration: |

|

Type: |

CallingPartyEnum, simple content |

|

enumeration of xsd:token

|

Enumeration: |

|

Type: |

CollateralArrangement, simple content |

|

xsd:normalizedString

|

maxLength: |

255

|

minLength: |

0

|

Type: |

DayCountFraction, simple content |

|

xsd:normalizedString

|

maxLength: |

255

|

minLength: |

0

|

Type: |

RepoDurationEnum, simple content |

|

("Open" | "Term") | "Overnight"

|

Type: |

AdjustableDate, complex content |

Type: |

xsd:boolean, predefined, simple content |

Type: |

RepoFarLeg, complex content |

Type: |

xsd:boolean, predefined, simple content |

Type: |

InitialMargin, complex content |

Type: |

RepoNearLeg, complex content |

Type: |

AdjustableOffset, complex content |

Type: |

AdjustableOffset, complex content |

Type: |

PartyNoticePeriod, complex content |

Type: |

PartyNoticePeriod, complex content |

Type: |

Frequency, complex content |

Type: |

GenericSecurity, complex content

|

Type: |

TriParty, complex content |

|

XML schema documentation generated with DocFlex/XML 1.10b5 using DocFlex/XML XSDDoc 2.8.1 template set. All content model diagrams generated by Altova XMLSpy via DocFlex/XML XMLSpy Integration.

|