element <fxAccrualOption> (global)

Namespace: |

|

Type: |

|

Content: |

complex, 1 attribute, 25 elements |

Subst.Gr: |

|

Defined: |

|

Used: |

never |

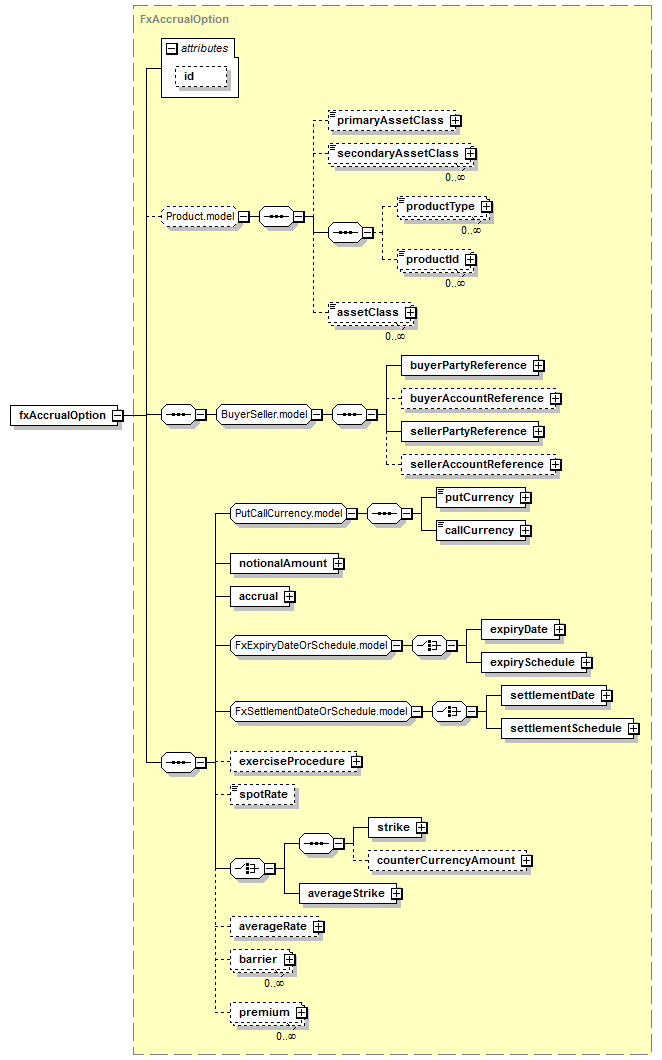

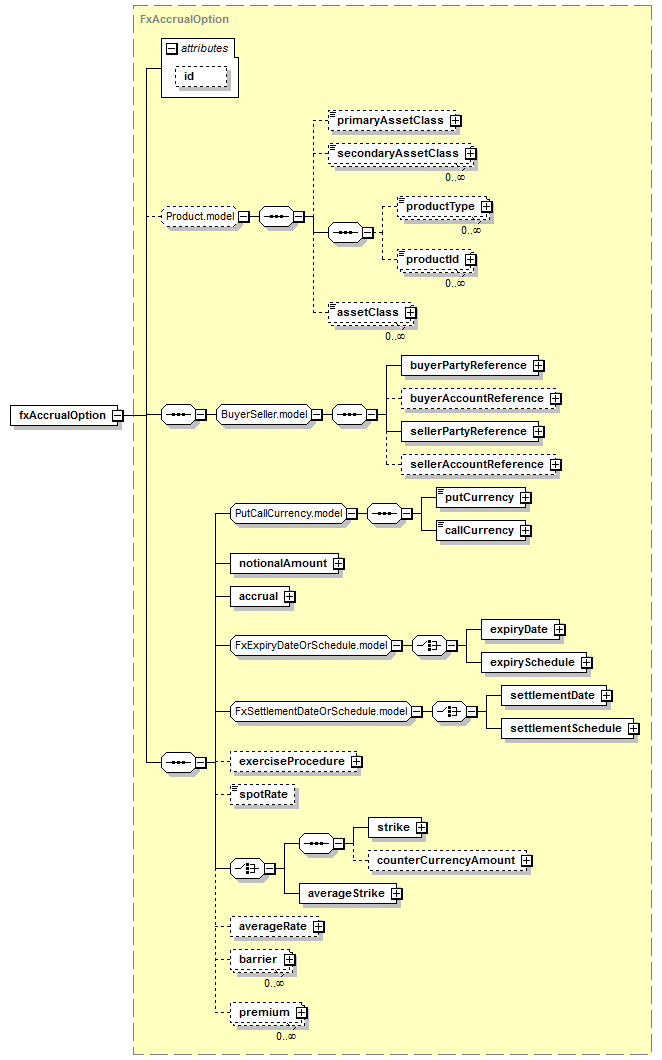

XML Representation Summary |

<fxAccrualOption |

|

|

|

> |

|

Content: |

( primaryAssetClass?, secondaryAssetClass*, productType*, productId*, assetClass*)?, buyerPartyReference, buyerAccountReference?, sellerPartyReference, sellerAccountReference?, putCurrency, callCurrency, notionalAmount, accrual, ( expiryDate | expirySchedule), ( settlementDate | settlementSchedule), exerciseProcedure?, spotRate?, (( strike, counterCurrencyAmount?) | averageStrike), averageRate?, barrier*, premium* |

|

</fxAccrualOption> |

Content model elements (25):

-

May be included in elements by substitutions (20):

-

Annotation

A financial contract between two parties (the buyer and the seller) that provides the buyer the right to buy a currency (or receive a payment) at expiry. The distinctive characteristic of this contract is that the Notional to be transacted at expiry is uncertain and depends on the amount of time that the underlying currency trades within a pre-set level, or levels (the 'accrual barrier', or 'barriers'). The total Notional is only known at the end of the accrual period, and this extra uncertainty can make an accrual option substantially cheaper than the comparable vanilla one.

XML Source (w/o annotations (1); see within schema source)