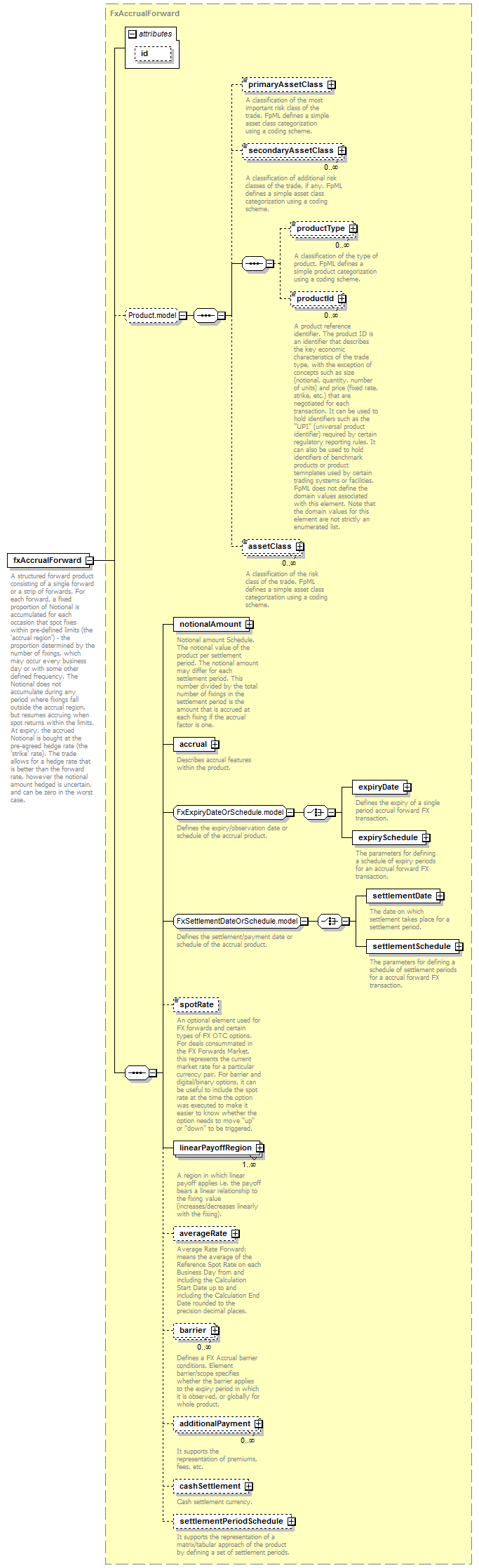

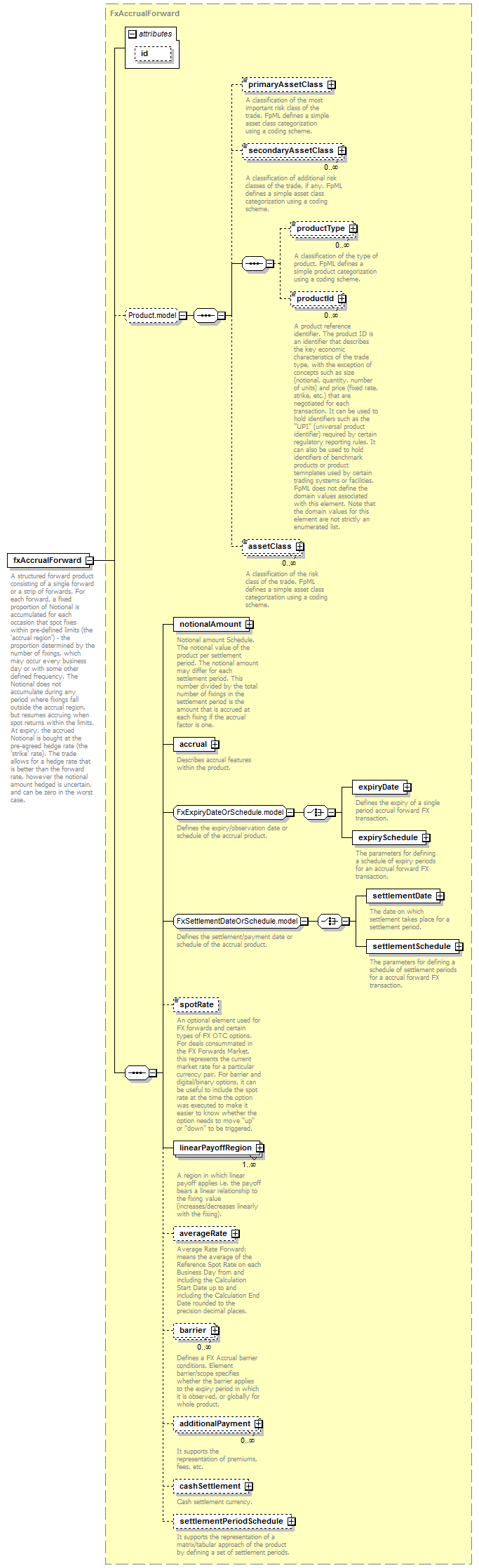

element <fxAccrualForward> (global)

Namespace: |

|

Type: |

|

Content: |

complex, 1 attribute, 18 elements |

Subst.Gr: |

|

Defined: |

|

Used: |

never |

XML Representation Summary |

<fxAccrualForward |

|

|

|

> |

|

Content: |

( primaryAssetClass?, secondaryAssetClass*, productType*, productId*, assetClass*)?, notionalAmount, accrual, ( expiryDate | expirySchedule), ( settlementDate | settlementSchedule), spotRate?, linearPayoffRegion+, averageRate?, barrier*, additionalPayment*, cashSettlement?, settlementPeriodSchedule? |

|

</fxAccrualForward> |

Content model elements (18):

-

May be included in elements by substitutions (24):

-

Annotation

A structured forward product consisting of a single forward or a strip of forwards. For each forward, a fixed proportion of Notional is accumulated for each occasion that spot fixes within pre-defined limits (the 'accrual region') - the proportion determined by the number of fixings, which may occur every business day or with some other defined frequency. The Notional does not accumulate during any period where fixings fall outside the accrual region, but resumes accruing when spot returns within the limits. At expiry, the accrued Notional is bought at the pre-agreed hedge rate (the 'strike' rate). The trade allows for a hedge rate that is better than the forward rate, however the notional amount hedged is uncertain, and can be zero in the worst case.

XML Source (w/o annotations (1); see within schema source)